Welcome,

I made this page to give potential investors like you an easy on-ramp into the business we’re building—and the opportunity to invest.

If you don’t know me, you’ll get a sense. If you’ve been following along, this will connect the dots.

Here’s what you’ll find below:

- The Hemorrhoid Problem & Solution: A $1B+ category waiting to be disrupted. Now there’s Norms. Better products. Modern marketing. Agile operations. Check out our launch SKUS live on the website.

- The Bigger Vision: Expansion across adjacent self-care categories. $40M+ in 2028. Built for acquisition. See how we get there below.

- The Investment Opportunity: Self-funded till now. Raising $1.5m on a SAFE. 90% committed. Target close in October. Live on Amazon. Official Norms launch October 30. Dig deeper with our deck and financials.

- The Brand In Action: Our marketing strategy coming to life. Content and digital

experiences, developed in-house. Ready for multi-platform campaign launch. Get a taste of what’s to come below.

Scroll down, poke around, and if it sparks anything, let’s talk.

— Joshua Katz, Founder

We’re Building the Brand That Goes Where Others Won’t

Norms is a modern personal care company focused on the problems most brands (and people!) avoid.

We’re starting with hemorrhoids—not because it’s funny, but because it’s a massive, highly-stigmatized category no one has treated the right way.

We see a huge opportunity to reimagine the way people treat taboo conditions—from the butt to the gut and beyond.

Our goal isn’t to make something trendy. It’s to build something trustworthy in the moments people feel most alone.

This isn’t a niche play. It’s a scalable platform for modern OTC care—with real category leadership and real returns in sight.

We've Launched A Full Suite of Maximum Strength Hemorrhoid Relief Products This Month

We developed three feel-good formats: Medicated Wipes, a Hemorrhoid Spray and a Hemorrhoid Cream. We've also got individually wrapped versions we call "Roadies" for when you're out-and-about or on the go.

- Homies

- Roadies

We're Serious About Our Ingredients

Our products are medical-grade, dermatologist-tested and clinically-proven. Every FDA-certified ingredient plays a precise role in delivering maximum relief. They're also formulated to be better for your body and for the planet.

Active Ingredients That Work:

- Lidocaine (Local Anesthetic) : Numbs the area to quickly relieve pain and itching

- Phenylephrine (Vasoconstrictor) : Tightens blood vessels to reduce swelling

- Glycerin (Protectant) : Forms a protective barrier to promote healing

- Witch Hazel (Astringent) : Soothes irritation and reduces inflammation

- Aloe (Soothing Agent) : Calms, hydrates and helps heal irritated skin

No Bad Stuff:

- Paraben-Free

- Phthalate-Free

- Plastic-Free

- Fragrance & Dye Free

- No Chemical Binders

- Hypoallergenic

We've Got A Winning Formula

- Proven Medical Formulas: The most successful & proven OTC medical formulations. Maximum strength. Rapid relief.

- User-Friendly Formats: Wipes, creams & sprays. For the home and on the road. Hygienic and easy to apply.

- Tasteful Packaging: Thoughtfully designed for discerning modern consumers. Like premium self-care CPG.

- Brand Forward: Purpose-driven. Connected to culture. Digitally native. Content & community oriented.

We Solve The Biggest Friction Points

No shame. No guesswork. No gimmicks.

We’re here to provide relief from hemorrhoids — and fix everything broken about how they’re treated.

From Humiliating to Buy → Discreet, Direct, and On-Demand

- We meet customers where they are: online—prioritizing DTC and fast delivery to eliminate pharmacy shame.

- Our product presentation is approachable, attractive, and intentionally low-key—designed to sit on a shelf, not hide in a drawer.

- We reframe self-care as something sensible, not secretive.

From Shameful to Own → Normal, Visible, and Proudly Yours

- Our brand design is confident but never clinical—neither cringe nor cutesy.

- We normalize ownership through lifestyle storytelling, real-people campaigns, educational content and a tone that says “we get it.”

- Our larger mission: to destigmatize an experience shared by more than half of all adults—and turn a taboo into a talking point.

From Awkward to Use → Clear, Clean, and Travel-Friendly

- We’ve created an intuitive product system that helps customers know what to use, when, and why.

- Packaging and education work hand-in-hand to simplify care—no confusing instructions or fine print.

- Our formats are hygienic, effective, and built for modern routines—from at-home treatment to on-the-go relief.

We Sell Where Our People Are Shopping

Unlike our predecessors, we’re capitalizing on the shift to digital-first discovery and purchase. Early wins in DTC and Delivery give us real leverage as we scale into mass retail.

Phase 1 Channel Launches (H2 2025)

- Getnorms.com (June)

- Amazon (July)

- TikTok Shop (Aug)

- Instant Delivery (Sept)

- Specialty Wholesale

Phase 2 Wholesale Expansion (2026)

- Mass Retail

- Pharmacy

- Convenience

Medicated Wipes

Hemorrhoid Spray

Hemorrhoid Cream

Squeezies

Wipe Outs

We’re Engineering Norms For Scale—and For Sale

Here's our go-to-market, growth and exit plan in three steps. This is how we build a category-leading, culturally-relevant, acquisition-ready business.

Step 1: Hemorrhoid Care

$675M TAM in USA by 2028

Hemorrhoid care, specifically over-the-counter hemorrhoid relief, is a massive & growing market just waiting to be disrupted. And the total addressable market bigger than most people think.

Lots of People Get Them

- 75% of adults get hemorrhoids

- 50% get them before age 50

- 15M Americans reported having hemorrhoids last year

- 40% of women get hemorrhoids during and after pregnancy

- 32% increase in prevalence since 2004

They Need Relief Frequently

- OTC medications & lifestyle modifications are recommended for 80% of cases

- At least 12M Americans should have used medication to treat their hemorrhoids last year

- Roughly 6 million Americans experienced hemorrhoid symptoms at least 57 days last year

$675m TAM In 2028 Is a Conservative Estimate

- We believe that many people who have symptoms don't treat them.

- 2024 sales could have been $1B+ if all 12m sufferers effectively treated an average of 3 flare ups that year.

- If we can help 5% more sufferers get the relief they need, we can add an incremental $33M/Y in sales

The Hole In The Hems Market

Today's OTC solutions fall short...when and where consumers need it most. Preparation H (which still has 65% share) may have been the go-to for our parents and grandparents. But who's thinking about the newest and segment of the market?

The Products Are Gross

- Toxic ingredients

- Unhygienic applications

- Sticky, greasy & smelly

The Whole Experience is Embarrassing

- Humiliating to buy

- Shameful to own

- Awkward to use

The Incumbent Brands Are Losing Market & Mind Share Because They Can't Keep Up With The Times

- Boomers → Gen X/Y

- Pharmacies → Online

- Products → Brands

- Stigmatized → Normalize

The Newer Entrants Haven't Been Able To Get Traction

- None have a complete care solution (single-SKU oriented)

- All-natural alternatives don't work

- Most lack brand & marketing sophistication

- All are under-capitalized

A new generation of disruptive embarrassing self care brands are wiping out their category incumbents' market share. But they haven’t touched this sensitive area.

This leaves a massive space for a relatable brand with products that really work

How We Fill It

We’re addressing a massive, underpenetrated category with outdated incumbents, low consumer engagement, and high emotional friction. By combining proven medical products with modern branding, clear UX, and stigma-breaking messaging, Norms is uniquely positioned to both capture share and expand the market.

What does success look like?

- Winning Amazon: In 2024, there was ~$50M of category sales on Amazon. In 2025, there will be 15% more. That's ours for the taking. We've got a real Brand. We've got better product. And we're going to be better at Amazon.

- Pioneering Social Commerce: Shopify is important. But the future of DTC is social. Our TikTok shop will be a profitable marketing channel. We'll prove that even buying hemorrhoid products can be a social affair.

- Redefining Convenience: Today, consumers that need fast relief (fast) have to go to the pharmacy. Tomorrow, they will get Norms delivered in 30 minutes or less. Or they'll pick us up at airports, convention centers, office vending machines, gyms and hotels.

- Repositioning In The Big Box Aisle: Hemorrhoid products have always been hidden on the bottom shelf. Not anymore! Top shelf products can get top shelf placement. And end caps too. We'll prove it.

Step 2: Category Expansion

From Butt to Gut. And Beyond.

Winning in hemorrhoids is a business in itself. But for us, it’s just the beginning.

We’re developing other high-margin OTC products for related and equally embarrassing conditions. We'll be taking on key categories of digestive health next.

The total addressable market for butt & gut treatments is expected to be $35B by 2028 in the USA alone.

And there's plenty more parts of the body that tend to itch, burn, flake and smell. We're going to help with that too.

Constipation & Diarrhea (2026)

Stool Softeners & Laxatives

- $3.27B TAM in 2028

- Market Leaders: Gax-X, MiraLax, Dulcolax, Metamucil

Antidiarrheals:

- $1.4B TAM in 2028

- Market Leaders: Imodium, Pepto-Bismol

Gas & Bloating (2026)

Gas & Bloating Medications

- $204M TAM in 2028

- Incumbent Leaders: Gax-X, Beano, Mylanta

- New Entries: Hilma, Wonderbelly, O Positiv

Athlete's Foot & Jock Itch (2027)

Topical Antifungal OTC Medications

- $1.8B TAM in 2028

- Market Leaders: Lotrimin, Tinactin, Lamisil

Other Private Predicaments (2028+)

- Skin: Eczema & Psoriasis

- Mouth: Halitosis & Cold Sores

- Hair: Dandruff

Step 3: Get Acquired

Built To Sell

This Isn’t a lifestyle business. It’s an M&A Play.

We’re building Norms to be the most acquirable hemorrhoid brand on the market. Differentiated. Proven. Profitable. Asset-light. Ready to scale.

- Most conglomerates lack a brand like Norms

- Private equity loves our lean, high-margin model

- Amazon, TikTok, and DTC dominance + traction in big box = acquirer proof points

With recent comps at 4–10x revenue and a clear path to $40M+, Norms offers rare early-stage upside—and a fast, focused path to a strong return.

$40M+ Business In 2028

We're starting smart and scaling fast. $40m in 2028 sales is very achievable with a 5% share of the US hemorrhoids market and initial moves into digestive health.

- Hemorrhoids OTC: 5% of $675M = $33M

- Laxatives: .2% of $3.27B = $5M

- Gas & Bloating: 3%of $204m = $6M

Other modern personal care start-ups have captured significant market share in much more competitive categories. And they've done it in two-to-five years.

- Ro (ED): 10% of $1.3B in 3Y

- Hims (Hair Growth): 2% of $3.6B in 3Y

- Starface (Acne): 3% of $4.9B in 3Y

- Ollie (Gut Health): 1% of $10B in 5Y

- Harry's (Mens Shaving): 8% of $3.3B in 5Y

- Billie (Wom Shaving): 2% of $1.5B in 4Y

- Native (Deodorant): 5% of $3.4B in 2Y

Primed For Acquisition

Most conglomerates don't have a hemorrhoid care business. None of them own an embarrassing self-care brand like Norms.

The Ones That Don't Compete

- Johnson & Johnson

- Procter & Gamble

- GlaxoSmithKline

- Edgewell

- Sanofi

- Colgate-Palmolive

- Unilever

- Reckitt Benckiser

The Ones That Own Our Competitors

- Pfizer (Preparation H)

- Blistex (Tucks)

- Church & Dwight Co. (Anusal/Recticare)

Church & Dwight’s recent $880M acquisition of Touchland (launched in 2020) proves they’ll buy modern, digitally-native and design-driven brands—even in categories they already compete in. Norms offers the same upside in a neglected OTC space, making it a strategic, not redundant, target for acquisition.

High Exit Multiples

Even in the more competitive subcategories of personal care, we've seen acquisitions at more than 4X multiples. Sometimes, for companies that haven't turned a profit.

- Touchland: Sold to C&D. $880M (6.8x Rev)

- Billie: Sold to Edgewell. $310M (5.5x Rev)

- Native: Sold to P&G. $100M (5x Rev)

- Hims&Hers: Oaktree SPAC. $1.6B (9x Rev)

- Sun Bum: Sold to J&J. $400M (5.7x Rev)

We’re Raising $1.5M on a SAFE

We held off on raising until everything was real—product, brand, ops, and traction.

Our target was $1M. We hit that goal in a few weeks. So we decided to go for $1.5M to give us more runway and make room for more great people that believe in what we're doing.

This isn’t an idea. The brand's ready. The products are made. The teams & systems are in place. The strategy’s in motion. We're live on Amazon and rolling out in other places this fall. Within a couple months, this will be a real brand & business.

I’ve self-funded and built everything myself—down to the last wipe. I didn’t start raising until I had real product, real progress, and a plan I could prove. Now we are bringing in partners with capital so we can do it right: inventory, marketing, and momentum.

(Heads Up: Password is required for this top secret stuff. No code, no problem. Email me at joshua@getnorms.com

We Don’t Just Market. We Make It Matter.

Every asset is crafted to resonate across platforms, provoke conversation, and make people feel seen.

Our approach to marketing is rooted in storytelling, not transactions. We lead with a cultural point of view—challenging stigma, earning trust, and showing up with honesty, humor, and design that meets people where they are.

The sampling below spans both launch and long-term. It’s content that educates without condescension, builds emotional stickiness, and flexes across TikTok, Instagram, Shopify, Amazon, IRL moments, and whatever comes next.

Some of it might seem a bit unconventional. But it's the special sauce that's going to drive performance and help us earn our place by making people care.

Norms Content Preview

Podcast-style sit-downs with well-informed people talking about embarrassing self-care issues

Totally Normal Conversations

We hired him to make hemorrhoids cool. He’s young, enthusiastic, and totally in over his head. His methods? Unclear. But he’s really giving it his all.

Colin. The Social Media Guy.

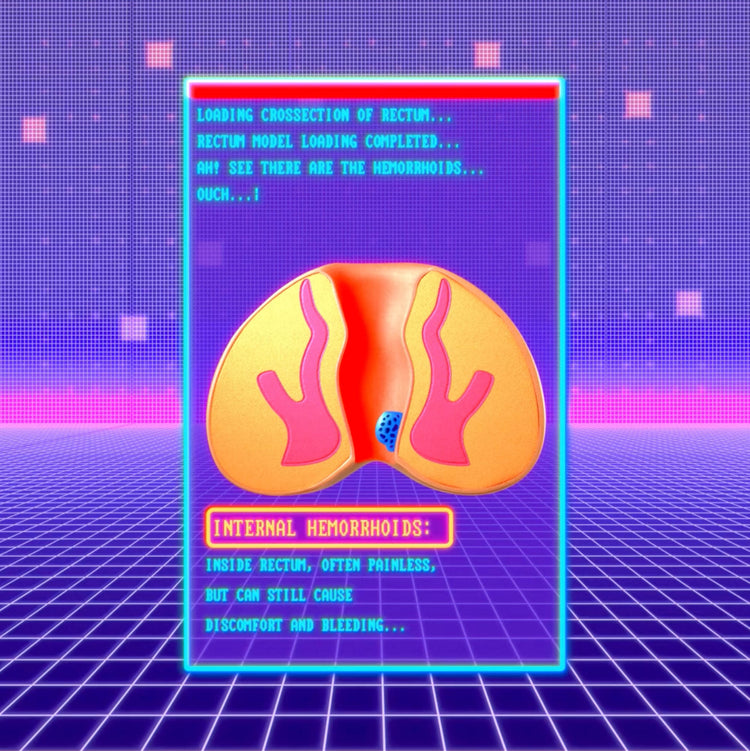

We make learning about Hemorrhoids and other gross bodily afflictions fun. The more you know...you know?

Educational Videos

Meet our heroic squad of butt-saving legends turning taboo relief into everyday superpower.

The Norm Core

Quick hits of knowledge from Dr. Wendi, our medical advisor and leading authority of matters from the butt to the gut.

Hemmies 101 and How-Tos

Hemorrhoids 101 With Dr. Wendi

How To Wipe, Cream & Spray

How To Use Norms Medicated Wipes

How To Use Norms Hemorrhoid Spray

How To Use Norms Hemorrhoid Cream

Totally Normal Conversations With Dr. Wendi

We're Going To Win This. Here's Why:

White Space

We’re the first to effectively service the largest and fastest-growing hemorrhoid-care audience segment (Gen X/Y/Z) by addressing their primary consumer friction points: Humiliating to buy, shameful to own and awkward to use. The incumbent has overwhelming market share but rapidly declining mind share and brand affinity, because they were built in and for a different era. That’s where we come in.

Proven Products

Instead of attempting to disrupt through innovation on day 1, we focus on the most successful & proven OTC medical formulations delivered in more user-friendly formats. Made by the same reputable cGMP/FDA-certified manufactures that produce for Prep H & Dr Butler’s. This means low R&D costs. No regulatory unknowns. Speed to market. And a low risk of product failure.

TAM Growth

Our “take a slice & grow the pie” strategy simultaneously captures market share from incumbents while opening up a large and untapped segment of consumers that have symptoms but don’t treat them. No other brand has a plan, or the tools, to help increase annual category sales by $30m. And no other brand is better positioned to be the brand-of-choice for the next generation.

Established Model

Other modern embarrassing self-care brands have successfully disrupted other categories but none of them have addressed anorectal care. That’s great for us. They’ve taught us how to win on Amazon, entice big box retailers and structure for exit. We’re the first hemorrhoids brand to borrow from and expand on their playbooks with a hyper focus on the problem/solution (sensitive area) they aren’t even talking about.

Timing

We’re launching our business into a steadily growing but relatively uncompetitive category while capitalizing on a critical inflection point in consumer behavior. The normalization of other embarrassing self-care issues. The shift from B&M pharmacies to online. The influence of community and social shopping. The aestheticization of CPG and increased focused on brands over products. This new paradigm favors a brand like us, a disruptive new entry that’s digitally native, brand-forward, and purpose-driven.

Competitive Moat

It’s not easy to bring-to-market FDA-regulated OTC products. Selling and marketing in a highly-regulated industry is also complex. Most start-ups wouldn’t know where to start. Others couldn’t afford to learn. We’ve already developed our first set of compliant products and are leveraging our hard-earned expertise and industry connections to stay above board and ahead of the regulatory curve.

Category Expansions

Our plan is to quickly become the leading modern hemorrhoid care brand so that we can expand into the digestive health markets and broader embarrassing self-care industry. By building our reputation and operating foundation in a relatively uncompetitive sub-segment, we’ll have the permissions and momentum to move “from the butt to the gut.” When we do, we’ll be a threat to both the incumbents and new entrants because we’ll come equipped with a strong brand, loyal following and competitive product propositions

Marketing Efficiency

We’ve operated DTC businesses and we know what’s broken in the conventional DTC marketing model. That’s why we’re hyper-focused on marketing efficiency and contribution margin over just topline growth. Earned & shared media over paid media. Community over simple commerce. No doubt, paid advertising is on our plan and critical for scale. But our overall cost for acquiring and retaining new customers will be significantly less than our DTC counterparts because we have a story that people will talk about, spread around, advocate for and buy into.

Experienced & Dedicated Founder

Joshua Katz has 20+ years working in fashion, hospitality, manufacturing and CPG. He’s led iconic global brands, launched new ones and even built a couple hotels and factories. He is the rare entrepreneur that can get in the weeds and then elevate to 40,000 feet. That can manage a balance sheet and creative direct an ad campaign. That can add value at all stages of a business’s growth and in almost every aspect of its operations. Norms is the culmination of Joshua’s diverse professional background. It taps into his vast professional network. It benefits from his deep professional experiences. And this time, with Norms, it’s very, very personal.

Positioned For Exit

We’re not building this to run it forever. We’re building it to sell. Norms is designed to be the most acquirable brand in its category—strategic, scalable, and surgically timed. Most OTC conglomerates either don’t have a hemorrhoid brand, or have one that can’t win with the next generation. Norms fills that gap with a design-forward, medically credible platform that’s built for modern channels. We’ve studied the exit landscape, identified the buyers, and architected the business to fit what they’re actually looking for. With recent comps trading at 4–10x revenue, and a clear path to $40M+, the upside is real—and the plan to get there is already in motion.